Article Directory

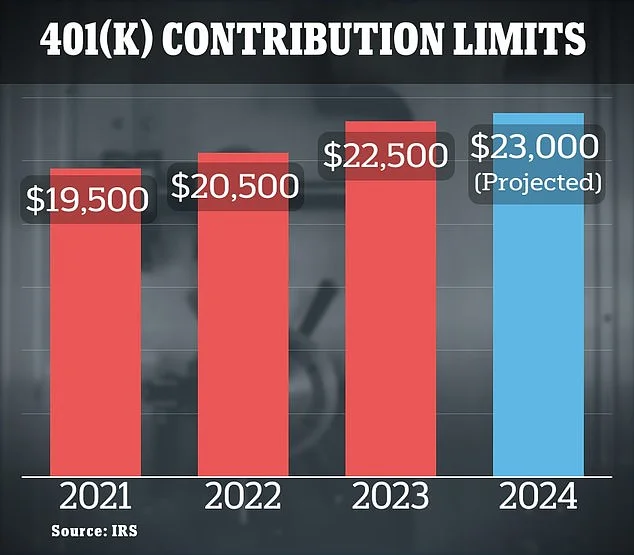

Alright, so the IRS is playing Santa Claus, huh? Bumping up the 401(k) contribution limit to $24,500 and the IRA limit to $7,500 for 2026. Big deal.

The Illusion of Choice

They act like this is some huge victory, a testament to the system working. Let's be real, it's just keeping pace with the dumpster fire that is inflation. We're running faster just to stay in the same place.

The IRS pats itself on the back, but what does this really mean for the average Joe? Sure, you can save more. But can you afford to? With grocery prices still sky-high and rent eating up half your paycheck... gimme a break. It's like offering a drowning man a slightly bigger bucket.

And the catch-up contributions for those over 50? A measly bump to $8,000 for 401(k)s and $1,100 for IRAs. Thanks, guys. Really feeling the love as I stare down the barrel of my impending, underfunded retirement. It's like they're saying, "Oops, almost forgot about you old timers. Here's a little something to shut you up."

Then there's the "super catch-up" for those aged 60-63, letting them contribute $11,250. Which, offcourse, is unchanged from last year. A fleeting moment of generosity in a lifetime of financial squeezing...

The Fine Print (As Usual)

Of course, there's always a catch, isn't there? The income eligibility ranges for IRAs and the Saver’s Credit are creeping up too, but it’s all relative. The goalposts move just far enough to keep most people struggling.

And let's not forget the Roth IRA phase-out ranges. Making too much to contribute directly? Backdoor Roth it is, then. More hoops to jump through, more complications. Because why make it easy?

I have to wonder, who actually benefits from these changes? The already wealthy, probably. The ones who can max out their contributions without breaking a sweat. The rest of us are just trying to survive, paycheck to paycheck. They expect us to be grateful for the crumbs they throw our way, and honestly...

It's like they're rearranging the deck chairs on the Titanic.

SECURE 2.0: A Band-Aid on a Bullet Wound

The SECURE 2.0 Act gets a mention, with its "super catch-up" provisions and cost-of-living adjustments. Sounds good on paper, but is it really moving the needle? Are a few extra bucks a year going to solve the retirement crisis? I doubt it. It's a band-aid on a bullet wound.

I mean, seriously, are we supposed to be impressed by this? A $500 increase to the IRA limit? That's like, what, an extra latte a week? It's insulting. According to New IRS Rules for 2026 Will Allow You to Contribute More to Your 401(k) and IRA, these changes are meant to help people save more for retirement.

So, What's the Point?

It all boils down to this: the system is rigged. These small increases are just a smokescreen, a way to make it look like they're doing something while the rich get richer and the rest of us scramble for scraps. Wake me up when they actually address the root causes of the problem – stagnant wages, rising costs, and a tax system that favors the wealthy. Until then, I'll keep my cynicism close.