Article Directory

Okay, folks, let's talk about the American Dream. White picket fence, right? But what if that fence is slowly draining your bank account? Zillow just dropped a bombshell: the hidden costs of owning a home are now cresting $16,000 annually. That's like, a whole extra mortgage payment… or maybe a down payment on a second home a few decades ago! Hidden costs of homeownership reach $16K per year

The Unseen Tax of "Home Sweet Home"

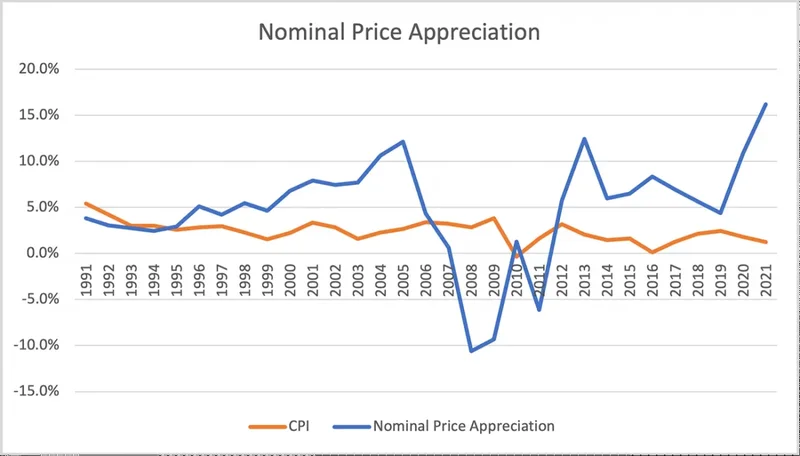

We’re not just talking about the mortgage, people. We're talking about the stuff that sneaks up on you like a ninja in the night: property taxes, insurance, and the big kahuna – maintenance. According to Zillow's analysis, maintenance alone accounts for nearly $11,000 of that total. Eleven thousand! Think about that for a second. That's a new roof every few years, or a lot of weekends spent unclogging gutters.

And get this: insurance premiums have jumped almost 50% in the last five years. In Florida, they're practically stratospheric. Miami's seen a 72% increase since 2020! It's almost enough to make you want to trade your oceanfront view for a sturdy, insurance-friendly bunker in Kansas.

Kara Ng, Zillow's senior economist, nailed it when she said insurance costs are "rising nearly twice as fast as homeowner incomes." Twice as fast! It’s not just a budget line item; it’s a barrier. A barrier to entry for first-time buyers, and a strain on families already feeling the pinch.

Now, some might say, "Well, that's just the cost of doing business." But I think it's more than that. It's a wake-up call. A call to re-evaluate what "homeownership" truly means in 2025. Are we setting people up for failure with this outdated ideal? Are we romanticizing something that's becoming increasingly unsustainable?

What if we started thinking about housing differently? What if we embraced more community-based living? Shared resources, co-ops, even just smaller, more manageable homes? Imagine a world where homeownership isn't a financial albatross, but a stepping stone to something bigger.

Thumbtack home expert Morgan Olsen suggests preventative maintenance as a "safety net." That's smart, but it feels like putting a band-aid on a much deeper wound. We need to address the systemic issues driving these costs up in the first place.

Is this the end of the American Dream as we know it? Absolutely not. But it is a chance to redefine it. To make it more inclusive, more sustainable, and more, well, realistic. This isn't just about numbers; it's about people. It's about ensuring that everyone has a fair shot at a comfortable, secure future.

And hey, maybe a little less lawn to mow wouldn't be so bad either. I saw a comment on Reddit the other day, someone saying they traded their suburban house for a city condo and haven't looked back since. "Less stress, more life," they said. Maybe that's the key.

Time to Reimagine the Dream

This isn't a crisis; it's an opportunity. A chance to build a better, more equitable future for everyone. Let’s not just wring our hands; let’s roll up our sleeves and get to work.